TLDR: we’re going to save the world by shorting companies, paying people crypto to protest, and using the profit to dismantle the worst polluters. It’s so stupid it just might work.

Relaxing day, so I’ll write about *the* idea I can’t get out of my head. Hopefully someone else will make it so I don’t have to. Ideally, cold fusion and political will to build a bright green future will both become widespread tomorrow and render it unnecessary. Realistically, I want to build this with *a lot* of help.

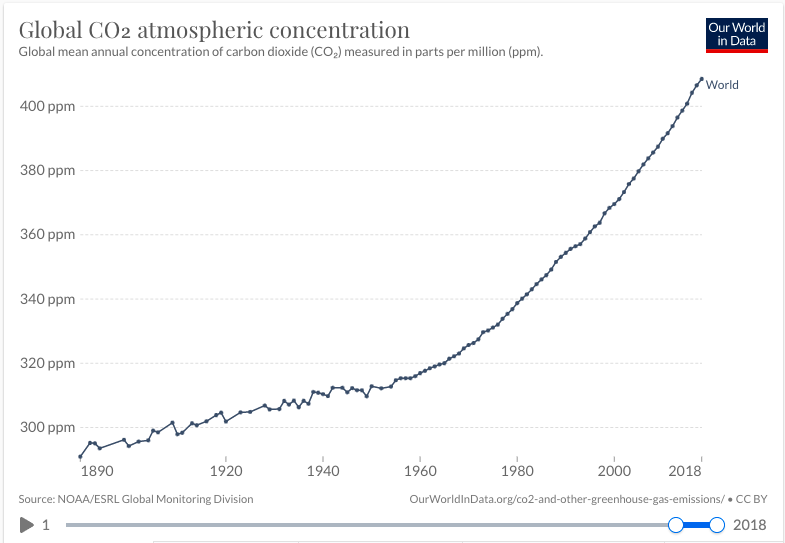

350, an atmospheric carbon level so important it inspired the name of a prominent NGO as recently as 2007, is now a laughable +62 PPM out the tailpipe. Even “radical” protesters largely treat property as people, collapsing into infighting at so much as a broken fast food store window. How To Blow Up a Pipeline‘s most radical element is its title. Devout Catholics daring to turn pipeline valves off and themselves in should expect to get met by years in prison.

Burning proven reserves, meaning resources oil companies have already found and markets have accounted for, will strip the adjective right off of “extreme weather.” I laughed aloud at sunset during fake Burning Man last month, the fiery red smoke-diffused orb being the first time I’d seen a sun I’d describe as “angry.” It could be said to have spoken many things to the chemically enhanced revelers, but I can’t even imagine a drug that’d make one look at that star and hear “Good job, humanity. Keep on keeping on.” I’ve slowly realized that I might spend the rest of my life being personally comfortable while watching the world burn…

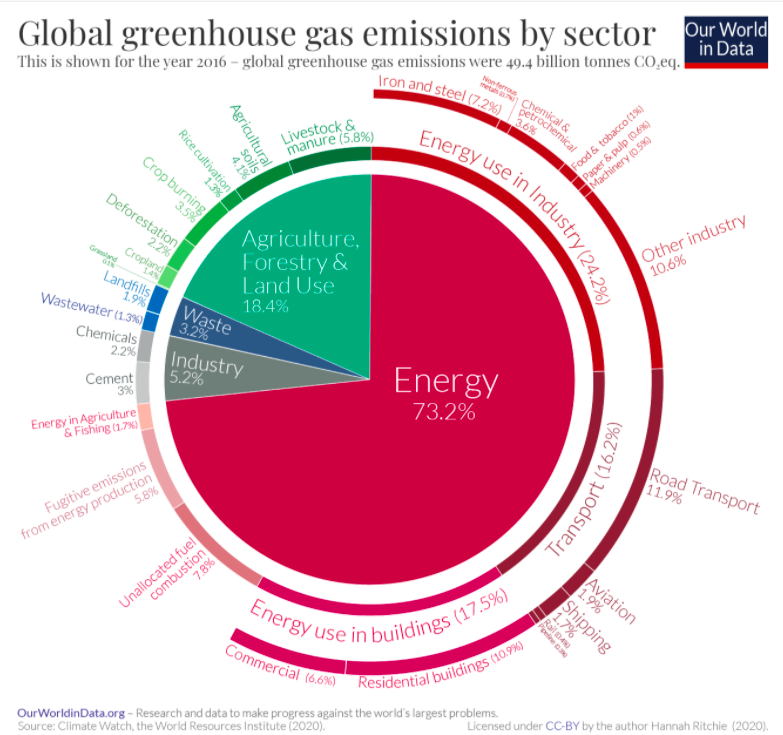

Changing our lightbulbs didn’t do it. Tesla are fun, and Priuses are functional. But, it’s largely not about luxury eco-signaling or self-sacrifice. Over 70% of global emissions are from 100 companies. Yeah make more sustainable choices and impact all the emissions further back in the supply chain that you can, just don’t expect this to matter much beyond hurting your wallet while salving your conscience.

If you actually care about where greenhouse gas emissions come from, here’s a breakdown.

But! We’re *soooo* close. New solar sometimes costs less per watt to install than it does to keep operating coal-powered power plants. Back to the land 2.0 but with fast internet and ebikes could be both fun and low-carbon. Ignoring flying and embodied energy, well-off westerners can emit little enough co2 per day to feel pretty responsible. Nuclear, drought-resistant open-source GMOs, “less but better” products designed for repair then reuse then recycling, and many more: we’ve got the tools to make a better tomorrow.

Yet we’re stuck in today. If only we could burn it down (figuratively, because carbon) and actually “build back better.” We need some way to make future costs come forward in time, to get companies to understand the consequences of global weirding will be as dire as the models predict.

We have this; it’s called an option.

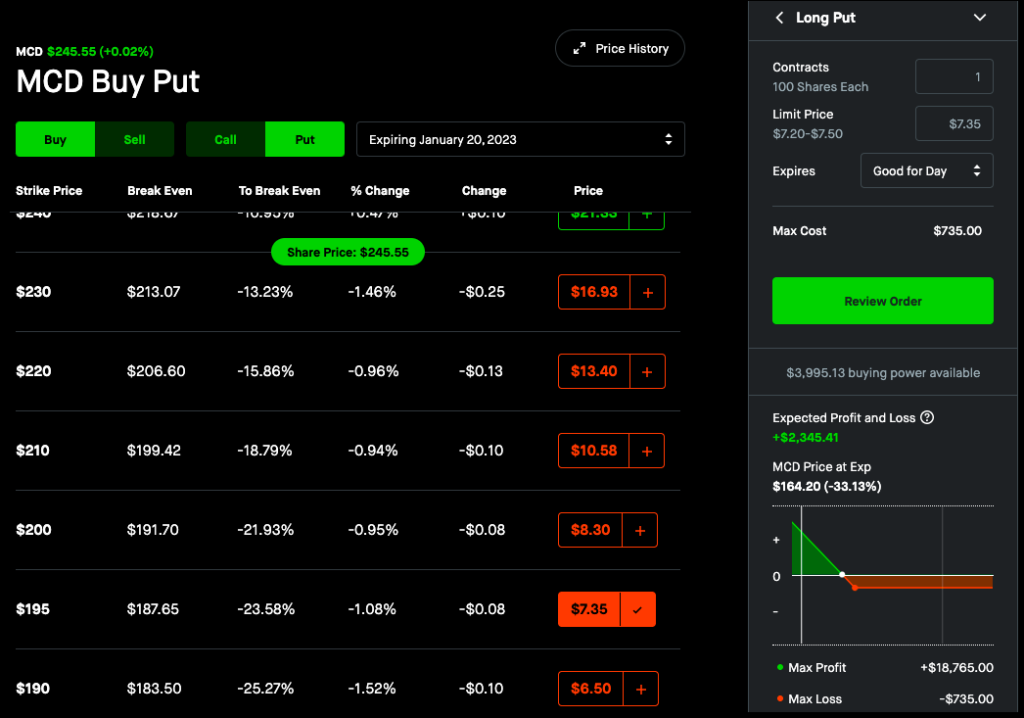

If my hatred of Big Macs leads me to think McDonald’s is going to be a much less valuable company in a year, I can buy a put: the right but not obligation to sell MCD at a specific price any time between now and the option’s expiration. In the image above, I can pay $735 for the right to sell 100 shares of MCD that I don’t own for $195 per share. If MCD is at 33% less on 1/20/23, I’d make $2,300 on an investment of $735.

If this sounds like a shady casino to you, you’re wrong. Sufficiently big companies get “all in” bets that they lose repaid. Fancy reports change how others bet. And, you can make money just by getting others to bet at specific tables.

Finance nerds did this to try and kill Gamestop, betting it’d decline in value by a specific date then loudly declaring Gamestop overvalued. Gaming nerds banded together to stop (really just delay) them, buying GME to increase its value. Reddit got a lot of pageviews, some rich assholes lost a bit of money, and some memes got made. Money is boring, and nerds gonna nerd.

Could we expand on this to kill oil companies? Market participants, both humans and algorithms, are spastic. These hippies blocked entrances to Starbucks in 3 cities today, but what if they’re in 30 more tomorrow? The potential to make $ and damage a company is much greater than the actual impact of the action on their bottom line. In theory, we could take over SBUX and shut it down by buying puts, protesting, using the returns from our options to buy more shares at new lower prices, and then getting to a majority ownership. See The Carls Saga for a more elegant explanation of some of this.

They’re early, but defi provides some tools that could make this actually work. I’m not smart enough to know for sure, but I think we’re close to able to use:

- Strong financial contracts with little to no trust: put ethereum into this contract’s address and it’s verifiably, programmatically required to then buy one of several options, choosing the exact option based on majority vote of others who have invested. or, randomness:)

- “Proof of protest:” the holder of this monero address was at this protest if holders of 3 other monero addresses say she was + bluetooth on her phone was near others that say they were + GPS. Yes this is probably weak, but compared to the 0 financial incentive for other protests…

- LLCs can be meaningfully, legally obligated to be controlled by DAOs

- Oracles: sources of truth to trigger contract actions, eg “exercise this option if stock price is <$x on date y”

Some objections:

- Is this illegal? I don’t think so, and it’s imho worth getting in trouble for. I mean, it’s not like I’m knowingly poisoning an entire town.

- People won’t invest in something so risky. Shiba Inu’s market cap is currently $26B, more than 1/3 that of Ford. I and many others invest in questionable things we barely pretend to understand.

- Target companies are too big and will defend themselves. Yup. Gotta start small, like a fracking ingredient provider or something. “Small publicly-traded oil-related company” unfortunately still tends to mean billions of dollars of market cap. But! Other greedy capitalists can invest in our stupid experiments. They can just want more green paper. No willingness to save world required;)

- Tactics will escalate. If this works at all, they’ll be “leak markets:” we’ll have whistleblowers making bank leaking about shady practices. Hell, we’ll have sex workers threatening to reveal Fortune 500 CEOs’ fetishes unless they pay living wages to all employees! ¯\_(ツ)_/¯

- People can use these tools against any big company. Yup. Companies are too big. Shouldn’t firms collapse in size given the drop in information transaction costs, Ronald?

Help! Talk me out of this and/or help me select targets + build the MVP. I’m particularly having a hard time finding a sufficiently small oil services company to short that’s got an adequate retail presence to be impacted by small protests. But! Money moves, and a couple successful tests will likely mean we get some other $s flowing at this. Carbon coin? Gaia? Last Ditch? Propaganda of the Deed Jury Nullification Token Dot Com? Clearly, I’ve got marketing and creative covered;)

I think you just talked me into it. 🚀🧨 the 5yr on GUSH index is intriguing. (There’s 25 holdings involved)

Starbucks =32k stations, Hess/speedway 3200.